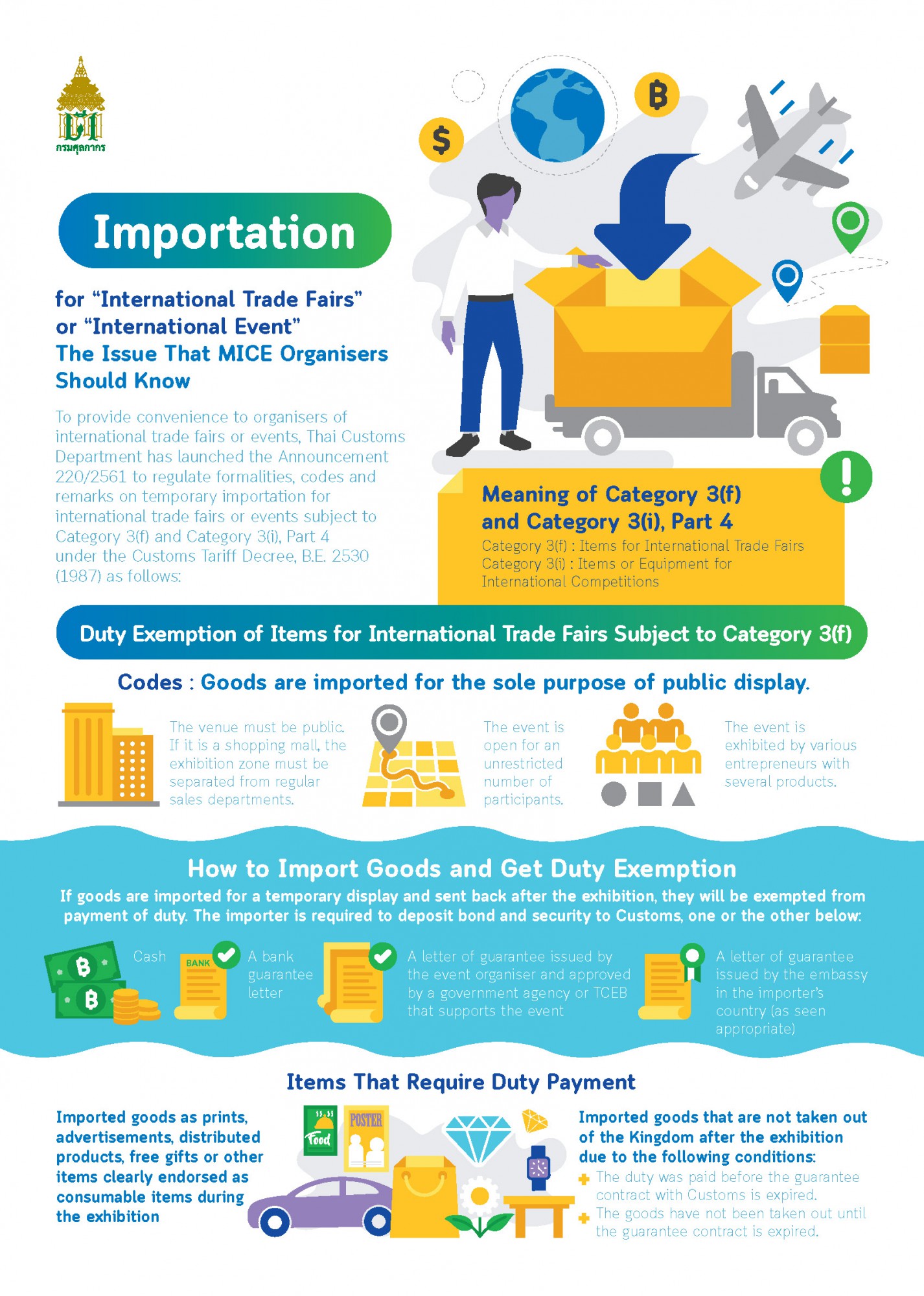

For convenience of the international event organizers, the Customs Departments has issued an announcement number 220/2561 indicating procedures and guidelines for temporary import for international exhibition or competition under Categories 3 (f) and (j) in Section 4 of the Customs Tariff Decree B.E. 2530, details as follows:

Definition of Categories 3 (f) and (j) in Section 4

Category 3 (f): Items for international exhibition

Category 3 (j): Items or equipment for international exhibition

Importer-Exporter registration with Customs Department

Traders must register to be listed in Customs Department’s online database in order to perform electronic Customs formalities.

Remark

Registration is not required if goods, transportation and insurance fees are less than 1,500 Baht in total and are not prohibited or restricted goods.

2

Prepare documents

To support the temporary import under Categories 3 (f) and (j) in Section 4

- Air Waybill/Bill of lading (AWB and/or B/L)

- Invoice

- Permits from related agencies (in case of imported items with permission) (if any)

- Import Entry declaration (draft copy)

- Letter of confirmation to organize event and venue booking for “International exhibition under Category 3 (f)” or “International competition under Category 3 (j)” issued by venue owner

- Registration for Re-Import Certificate and request to use the certificate as guarantee

- Letter of confirmation on “International exhibition under Category 3 (f)” or “International competition under Category 3 (j)” issued by a government agency or TCEB sponsoring the event

- Letter of guarantee and Import Credentials

Submission

The Thai Chamber of Commerce

- 150 Ratchabophit Rd, Wat Ratchabophit, Phra Nakhon, Bangkok 10200

- +66 2018 6888

- tcc@thaichamber.org

- bot@thaichamber.org

- Website

3

Duty payment

Customs Department

- Printed matter, advertisement, sample goods, giveaways obviously depletable during the exhibition

- Imported goods that are not re-exported out of the Kingdom, or duty is paid before the expiry date of the guarantee submitted to the Customs Department, or goods not re-exported out of the Kingdom and the guarantee has expired

Value Add Tax, excise tax, local government tax, and other taxes and duties can be paid via electronic banking or contact the Duty Accounting Sub-division, 2nd Floor, BC-1 Building during office hours. Alternatively, go to Customs Export Clearance (CE) Building outside office hours.

Learn More

Lists of Frieght Forwarders

Please review the list for convenient process

Temporary Import for International Exhibition or Competition

Temporary Import for International Exhibition or Competition