The ATA Carnet is an international customs document used in lieu of Export Entry, Import Entry, Re-Importation Certificate, and Transit document from one Customs Checkpoint to another within the country. It also acts as a guarantee for Customs duty of temporary imported items which have been exempted from Customs duty under the ATA Carnet Convention.

Procedures under e – Import

Check list of eligible countries from Thai Chamber of Commerce

2

Duration of ATA CARNET issuance

- 3 Working days for normal cases

- 1 Working day for urgent cases, counting from the day complete documents have been received

3

Importing under ATA Carnet

Procedures

Submit Import Counterfoil

Submit both Import/Re-Exportation counterfoil (white sheet) and voucher which have been completely filled in, along with supporting documents at Customs Office or Customs Checkpoint of import.

Customs Checking

Customs officer will check documents and issue Customs duty exemption number or Customs duty payment number (if any), or contact Goods Inspection Section to collect goods from Customs Bond.

Re-Exportation

Submit Re-Exportation Counterfoil

Submit both Re-Exportation counterfoil (white sheet) and voucher which have been completely filled in, along with supporting documents at Customs Office or Customs Checkpoint of export

Customs Checking

Customs officer will check documents and issue Customs duty exemption number or Customs duty payment number (if any), or contact Goods Inspection Section to collect goods from Customs Bond.

4

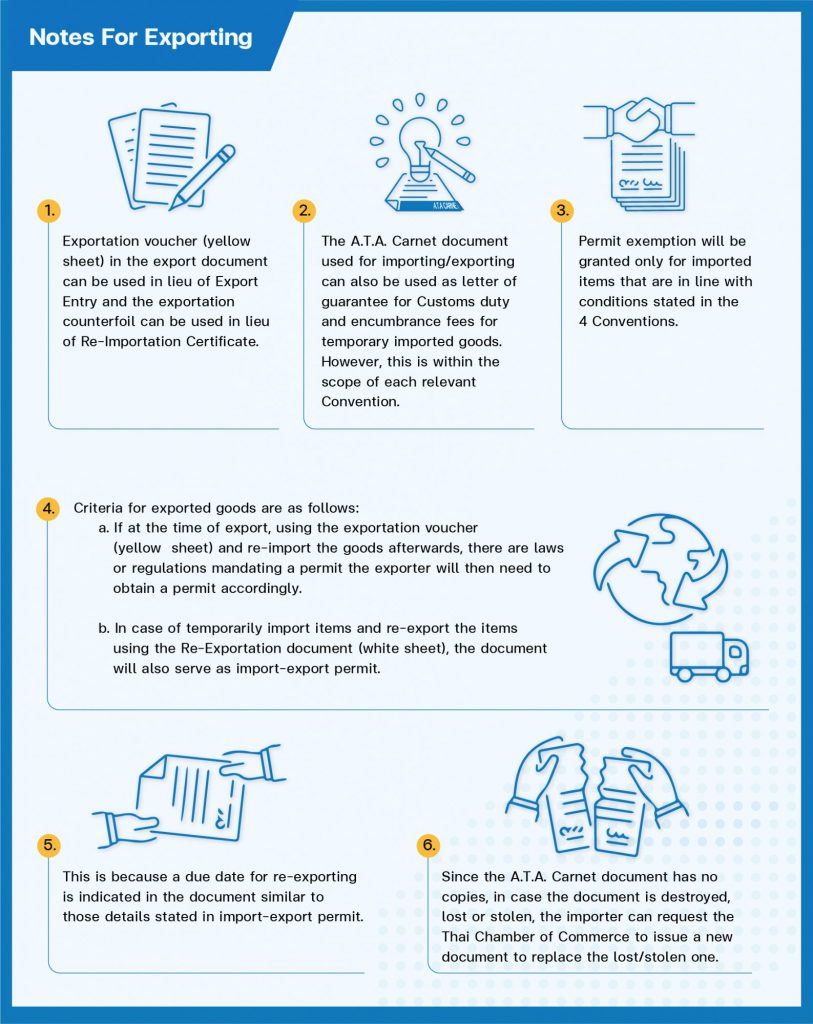

Exporting under ATA Carnet

Procedures

Submit both Export/Re-Importation counterfoil

Submit both Export/Re-Importation counterfoil (yellow sheet) and voucher which have been completely filled in, along with supporting documents excluding invoice or packing list. The exporter will have to declare details of items in the export document for officer to verify at Customs Office or Customs Checkpoint of export.

Customs Checking and Duty Payment (if any)

Customs officer will check documents and issue Customs duty exemption number or Customs duty payment number (if any) and return all documents to the exporter to proceed with cargo inspection and release or Customs duty payment depending on the situation.

Re-Importation

Submit Re-Importation counterfoil

Submit Re-Importation counterfoil (yellow sheet) and voucher as well as Release Order and supporting documents to Customs Office or Customs Checkpoint of import.

Customs Checking and Duty Payment (if any)

Customs officer will check documents and consider the approval of Customs duty exemption. All documents will then be returned to the importer to proceed with cargo inspection and release. To do this, contact Goods Inspection Section to collect goods from Customs Bond.

Learn More

Lists of Freight Forwarders

Please review the list for your convenient process